News

Archer Exploration to Acquire the Grasset Nickel Deposit and Other Nickel Assets from Wallbridge Mining

Creating a Leading Nickel Exploration and Development Company

July 13, 2022 – Archer Exploration Corp. (CSE: RCHR) (“Archer”) is pleased to announce that it has entered into a definitive asset purchase agreement dated July 12, 2022 (the “Asset Purchase Agreement”) with Wallbridge Mining Company Limited (TSX: WM) (“Wallbridge”). Pursuant to the Asset Purchase Agreement, Archer will acquire (the “Transaction”) all of Wallbridge’s nickel assets, rights and obligations located in Quebec and Ontario (collectively, the “Nickel Assets”). Archer is backed by Inventa Capital Corp., a Vancouver-based merchant bank founded in 2017 with the goal of discovering and funding opportunities in the resource sector.

The Nickel Assets consist of 2,046 mining titles covering approximately 67,000 hectares and include a 100% interest in the Grasset nickel sulphide project located in Quebec (the “Grasset Project”).

Transaction Highlights

- Creation of a new Canadian nickel development company: The Transaction will establish Archer as a leading Canadian nickel sulfide focused exploration and development company with assets in the established mining jurisdictions of Quebec and Ontario.

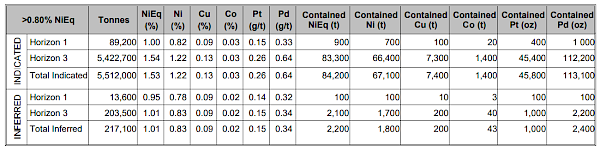

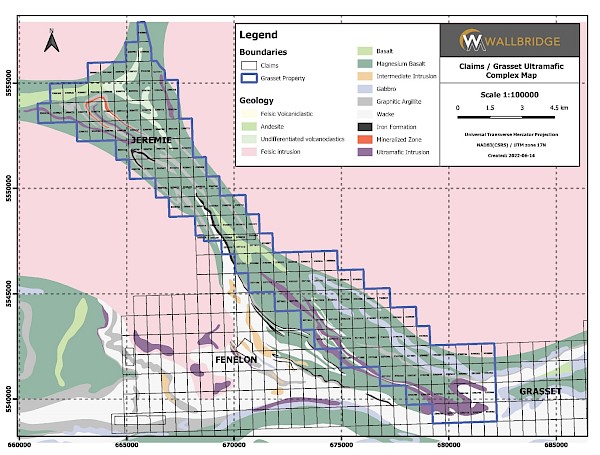

The Grasset Project represents the core asset in the portfolio of Nickel Assets and comprises 8,180 hectares in the Abitibi greenstone belt located approximately 55 km west-northwest from the town of Matagami, Quebec (see Figure A). As noted in the technical report entitled “NI 43-101 Technical Report for the Detour-Fenelon Gold Trend Property, Quebec, Canada”, completed on December 23, 2021 by Carl Pelletier, P.Geo. and Vincent Nadeau-Benoit, P.Geo. filed by Wallbridge, the Grasset Project hosts an indicated mineral resource totalling 5.5 Mt @ 1.53% NiEq (the “Resource Estimate”) (see Table 1). Archer believes that the Grasset Project has significant expansion potential as demonstrated by open resource grade drill intercepts and untested surface and borehole electromagnetic conductor anomalies at depth and along strike. - Large land position in proven mining districts: Upon completion of the Transaction, Archer will acquire a large portfolio of best-in-class “green metal” Ni-Cu (-Co PGE) projects located within the prolific Abitibi greenstone belt in Quebec and the Sudbury basin in Ontario.

- Strong expansion and discovery potential: The Nickel Assets include exciting discovery-stage greenfield to advanced-stage magmatic sulphide projects that will allow investors to participate in multiple discovery to development catalyst events in the future.

- Sudbury assets provide significant optionality in current nickel environment: The Nickel Assets include 801 prospective mining and exploration properties within discovery-rich areas of the prolific Sudbury mining camp which are expected to provide significant optionality going forward for funding and development.

- Strategic partnership with Wallbridge: Upon closing of the Transaction and the Share Distribution (as defined below), Wallbridge will be the largest shareholder in Archer and will hold approximately 19.9% of the outstanding common shares of Archer (the “Archer Shares”).

- Experienced management team and board: Archer is assembling a management team and board of directors with deep mining industry experience and strong track records of value creation, major discoveries, project execution and M&A transactions. Details regarding the management team and board of directors will be announced by Archer in a subsequent news release.

Keith Bodnarchuk, Interim Chief Executive Officer of Archer, commented, “This is a transformational day for Archer. Our team has searched worldwide to identify and secure an attractive land portfolio that features an advanced nickel sulphide resource with apparent upside that is complemented by an exciting pipeline of high-impact nickel sulphide exploration targets. The Grasset deposit and the 23 km long, target-rich regional package ticks these boxes. Then add to Grasset a giant land package in the world-class Sudbury mining camp and highly prospective greenfield projects in northern Quebec and NW Ontario and Archer becomes a leading Canadian nickel exploration and development company. This transaction is a direct result of an unrelenting, collaborative effort by both the Archer and Wallbridge teams towards unlocking the huge potential value of a best-in-class nickel portfolio during a period of unparalleled demand for green metals. We look forward to combining the strong shareholder bases of the two companies and working closely with the Wallbridge team and local stakeholders to create value.”

The Nickel Assets

Quebec

Additional komatiite-associated Ni-Cu(-Co-PGE) sulphide mineralization has been discovered at several other localities within a 23 km-long corridor on the Grasset Project, including along the 16 km long Grasset Ultramafic Complex that hosts the Resource Estimate and the Central prospect located 9 km from the Grasset Project. Limited historic drilling at Central intercepted high-grade mineralization including 4.14% Ni, 0.26% Cu, 0.18% Co, 0.81 g/t Pt and 1.93 g/t Pd over 0.65 m over a broader 7.58 m mineralized intercept grading 1.05% Ni, 0.31% Cu, 0.05% Co, 0.20 g/t Pt and 0.48 g/t Pd (source: “2020 Technical Report: The Fenelon Property, NI 43-101 Report, Fenelon Township – Province of Quebec, Canada”, dated March 27, 2020 and prepared for Balmoral Resources Ltd. by Judith Marian Myers, P.Geo., M.Sc. (principal author) and Darin Wagner, P.Geo., M.Sc. (co-author)). Archer intends to conduct follow-up exploration on these nickel prospects.

Komatiite-associated nickel deposits have been important global sources of nickel, copper and PGE minerals, and are found in other prolific Archean greenstone belts, such as the Eastern Goldfields greenstone belt of Western Australia and the greenstone belts of Zimbabwe and Finland. Archer hopes that the Grasset Project, and subsequent discovery of additional Ni-Cu (-Co-PGE) mineralization along strike at the Grasset Project, may indicate the potential for a significant new nickel district within the northern Abitibi region.

- Grasset Project: The Grasset Project includes the Resource Estimate which Archer believes has significant expansion potential as demonstrated by open resource grade drill intercepts and untested surface and borehole electromagnetic conductor anomalies at depth and along strike. The higher-grade sulphide mineralization that comprises the Resource Estimate is found in two steeply dipping, stacked, tabular zones. Much of the intervening rocks that separate these two resource zones is also mineralized, resulting in a greater than 200m thick mineralized body of rock – a potential indication of a large-scale, robust mineralizing system that offers additional discoveries. Furthermore, the high nickel tenors of the mineralization at the Grasset Project may be capable of producing high-grade massive sulphide zones.

- RUM Project: Comprising 8,966 hectares of property on 164 claim blocks, the RUM project (the “RUM Project”) is a grassroots exploration property located 150 km northwest of Matagami, Quebec. Archer believes that the RUM Project is prospective for mafic/ultramafic hosted, magmatic Ni-Cu(-Co-PGE) mineralization with a drill-ready Ni-sulphide showing (Bluenose Zone), and has geological similarities to the nearby Lac Rocher Ni deposit. Archer believes that there may be multiple other untested airborne magnetic/VTEM targets spread across all the claim blocks at the RUM Project.

Ontario

- Sudbury Project: The Nickel Assets include a large property package comprised of 30,984 hectares within 807 mining titles, including the Parkin, Wisner, North Range, Windy Lake, Trill, South Range, South Range West and Wahnapitae projects (collectively, the “Sudbury Project”). The Sudbury Project is located within the world-class mining district of Sudbury, selected on the basis of recognised prospective geological settings and proximity to several significant producing mines. Archer believes that offset dykes, particularly at the Parkin and Trill projects may retain considerable upside discovery potential for high-grade nickel that remains open at depth with insufficiently drilled high-grade ore shoots present at variable depths. Discovery upside may exist for copper-rich footwall-style mineralization along strike from large producing mines within the East and South Range project areas. There is significant optionality for funding and developing the known deposits and prospects on other areas of the Sudbury Project.

- NW Ontario Project: The Nickel Assets also include a 15,555 hectare grassroots exploration package located within the Archean Lumby Lake greenstone belt near Thunder Bay, consisting of 735 claims spread across three properties called Gargoyle, Ghost and Goblin (collectively, the “NW Ontario Project”). The Archean Lumby Lake greenstone belt is comprised of a succession of rocks favorable to hosting economic magmatic Ni deposits, including komatiitic volcanic and intrusive sequences intimately intermixed with sulphide-bearing sedimentary units. Archer expects that the immediate target within the Gargoyle block of the NW Ontario Project will be a 1 km long zone of outcropping magmatic Ni sulphide-bearing ultramafic rocks that closely coincide with an extensive series of electromagnetic anomalies, none of which has ever been drill-tested.

The Company has also agreed to assume obligations under the closure plan relating to Wallbridge’s Broken Hammer open pit mine which ceased operation in 2015.

Table 1: Resource Estimate1,2

Notes:

- The Resource Estimate is based on a 0.80% NiEq cut-off grade. The independent and qualified person for the Resource Estimate, as defined by NI 43 101, is Carl Pelletier, P.Geo. (InnovExplo Inc.). The effective date of the Grasset 2021 MRE is November 9, 2021. These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The Resource Estimate follows 2014 CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines. Two mineralized zones were modelled in 3D using a minimum true width of 3.0 m. Density values are interpolated from density databases, capped at 4.697 g/cm3. High-grade capping was done on raw assay data and established on a per zone basis for nickel (15.00%), copper (5.00%), platinum (5.00 g/t) and palladium (8.00 g/t). Composites (1-m) were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed. The Resource Estimate was completed using a block model in GEMS (v.6.8) using 5m x 5m x 5m blocks. Grade interpolation (Ni, Cu, Co, Pt, Pd, Au and Ag) was obtained by ID2 using hard boundaries. Results in NiEq were calculated after interpolation of the individual metals. The Resource Estimate is categorized as indicated and inferred based on drill spacing, geological and grade continuity. A maximum distance to the closest composite of 50 m was used for indicated mineral resources and 100 m for the inferred mineral resources. The criterion of reasonable prospects for eventual economic extraction was met by having constraining volumes applied to any blocks (potential underground extraction scenario) using DSO and by the application of a cut off grade of 0.80% NiEq. Cut-off calculations used: Mining = C$65.00/t; Maintenance = C$10.00/t; G&A = C$20.00/t; Processing = C$42.00/t. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.). The NiEq formula used a USD:CAD exchange rate of 1.31, a nickel price of US$6.95/lb, a copper price of US$3.33/lb, a cobalt price of US$17.06/lb, a platinum price of US$984.85/oz, and a palladium price of US$2,338.47/oz. Gold and silver do not contribute to the economics of the deposit. Results are presented undiluted and in-situ. Ounce (troy) = metric tons x grade / 31.10348. Metric tons and ounces were rounded to the nearest hundred. Metal contents are presented in ounces and pounds. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations in NI 43-101. The QP is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect the Resource Estimate.

- The quantity and grade of reported inferred resources in the Resource Estimate are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category.

To the best of Archer’s knowledge, information and belief, there is no new scientific or technical information that would make the disclosure of the Resource Estimate inaccurate or misleading. Pursuant to section 4.2(7)(c) of National Instrument 43-101, Archer will file a technical report supporting its disclosure of the Resource Estimate within 180 days after the date of this news release.

Summary of the Transaction

Pursuant to the Asset Purchase Agreement, Archer will acquire the Nickel Assets from Wallbridge in exchange for 198,635,786 Archer Shares (each, a “Consideration Share”) at a deemed value of C$0.27 per Consideration Share for a purchase price of approximately C$53.6 million. In addition to issuing the Consideration Shares, Archer will also grant Wallbridge a net smelter return royalty on production from the Grasset Project.

Wallbridge has agreed to complete a partial distribution of Consideration Shares by way of a reduction of stated capital to its shareholders on a pro rata basis (the “Share Distribution”) within 60 days of closing of the Transaction. Following the Share Distribution, Wallbridge will own 19.9% of the Archer Shares following closing of the Transaction and related matters.

The Transaction will constitute a “Fundamental Change” of Archer within the meaning of the policies of the Canadian Securities Exchange (the “CSE”).

Completion of the Transaction is subject to a number of conditions precedent, including, but not limited to: (i) acceptance by the CSE and receipt of other applicable regulatory approvals; (ii) receipt of approval of the shareholders of Archer; (iii) completion by Archer of a private placement for gross proceeds of at least C$10,000,000 (the “Financing”); and (iv) certain other closing conditions customary for a transaction of this nature.

Upon completion of the Transaction and the Share Distribution (and not taking into account the Financing or the issuance of Archer Shares to the Finders (as defined below)): (a) current shareholders of Archer will hold approximately 15% of the Archer Shares on a fully-diluted in the money basis, and (b) Wallbridge and shareholders of Wallbridge will hold approximately 85% of the outstanding Archer Shares on a fully-diluted in the money basis.

In connection with the Transaction, Archer entered into a finder’s fee agreement dated as of June 10, 2022 with two arm’s length parties (the “Finders”). As compensation for the Finders’ introduction of Archer and Wallbridge, should the Transaction be completed, Archer will pay to the Finders collectively a number of Archer Shares equal to 2.5% of the number of Consideration Shares. The finder’s fee is subject to approval of the CSE. Any Archer Shares issued to the Finders will be subject to escrow and released over a period of two years after closing of the Transaction. The Finders have agreed to notify Archer of any potential disposition of Archer Shares and allow Archer the opportunity to designate the purchase of all or any portion of such shares.

The Archer Shares have been halted and may remain halted until the completion of the Transaction. There can be no assurance that the Transaction will be completed on the terms proposed or at all.

Details regarding the Financing and the post-Transaction composition of Archer’s management team and board of directors will be announced by Archer in a subsequent news release. Further details will also be provided in a CSE listing statement prepared and filed by Archer in respect of the Transaction.

Ancillary Agreements

In connection with closing of the Transaction, Archer and Wallbridge will enter into a royalty agreement (the “Royalty Agreement”), an investor rights agreement (the “Investor Rights Agreement”), and an exploration cooperation agreement (the “Exploration Cooperation Agreement”).

The Royalty Agreement will provide for a royalty equal to 2% of net smelter returns less the amount of any pre-existing royalties on encumbered portions of the Grasset Project. In certain circumstances, Wallbridge will be granted a right of first refusal to acquire any new royalties sold by Archer on the Grasset Project.

The Investor Rights Agreement will provide, among other things, that for so long as Wallbridge holds at least 10% of the issued and outstanding Archer Shares, it will have a pro rata pre-emptive right, top-up rights and a standard piggyback registration right subject to underwriter cutback. In addition, Wallbridge will agree to not dispose of any Archer Shares, other than in connection with the Share Distribution, for a period of one year. Additionally, Wallbridge will have the right to nominate two directors to Archer’s board of directors, with the current nominees being Marz Kord, Chief Executive Officer of Wallbridge and Brian Penny, Chief Financial Officer of Wallbridge.

The Exploration Cooperation Agreement applies to the Grasset Project but excludes those portions which are subject to the Resource Estimate (the “Gold Cooperation Area”). Pursuant to the Exploration Cooperation Agreement, Wallbridge will be granted the right to explore the Gold Cooperation Area for gold in certain circumstances. If the results from either Wallbridge’s or Archer’s exploration work in the Gold Cooperation Area establish a mineral resource that consists of primary gold mineralization, then the parties will form a joint venture in which Archer will have a 30% interest and Wallbridge will have a 70% interest. If the results from Wallbridge’s exploration work in the Gold Cooperation Area establish a mineral resource that consists of primary mineralization other than gold, then the parties will form a joint venture in which Archer will have a 70% interest and Wallbridge will have a 30% interest. The purpose of any such joint ventures will be to explore, develop and operate such mineral resource. The Exploration Cooperation Agreement has a term of five years and is subject to earlier termination in certain circumstances.

Zanzui Update

Further to its news releases dated December 15, 2021 and May 31, 2022, Archer has terminated the securities exchange agreement entered into on December 13, 2021 with Echelon Minerals Ltd. (“Echelon”) and the shareholders of Echelon. Funds previously advanced by Archer to Echelon will be forgiven. Archer will focus on the acquisition and advancement of the Nickel Assets rather than pursuing the Zanzui project in Tanzania.

Qualified Persons

In accordance with NI 43-101, Keith Bodnarchuk, P.Geo., Interim CEO, is the Qualified Person for Archer and has reviewed and approved the technical and scientific content of this news release.

Carl Pelletier, P.Geo., a Qualified Person under NI 43-101, is responsible for the Resource Estimate and has approved the technical and scientific information contained in this news release relating to the Resource Estimate.

For more information, please contact:

Keith Bodnarchuk

Interim Chief Executive Officer

Tel: (778) 867-2631

Email: ac.latipacatnevni@htiek

Cautionary Note Regarding Forward-Looking Statements

Neither the CSE nor its Market Regulator (as that term is defined in policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that Archer expects or anticipates will or may occur in the future. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. These forward-looking statement or information may relate to: obtaining the required regulatory approvals and fulfilling other closing conditions related to the Transaction; closing of the Transaction; closing of the Financing and the terms thereof; the composition of the board of directors and management team of Archer; the filing of a technical report supporting disclosure of the Resource Estimate within 180 days after the date of this news release; exploration and development of the Nickel Assets; completion of the Share Distribution; the issuance of Archer Shares to the Finders; the filing of a listing statement in respect of the Transaction; commencement of trading of Archer Shares; the impact of the Transaction on Archer’s business; mining operations; the business plan of Archer; projected quantities of future mineral production, interpretation of drill results and other technical data; anticipated development, expansion and exploration activities; viability of Archer’s projects and properties; exploration activities required to classify the Resource Estimate as a current resource; and the entering into of ancillary agreements in connection with the Transaction.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct Archer’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Archer in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: that there is no assurance that the parties hereto will obtain the requisite shareholder and regulatory approvals for the Transaction, and there is no assurance that the Transaction will be completed as anticipated, or at all; there is no assurance that any proposed financings will be completed or as to the actual offering price or gross proceeds to be raised in connection with such financings; following completion of the Transaction, Archer may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect Archer’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of Archer’s securities, regardless of its operating performance; the impact of COVID-19; the ongoing military conflict in Ukraine, and other risk factors set out in Archer’s public disclosure documents.

The forward-looking information contained in this news release represents the expectations of Archer as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Archer does not undertake any obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Figure A